How Our Bookkeepers Simplify Tax & Payroll Challenges

Records & Information Management

Accounts Payable and Receivable

Trial Balance

Payroll Management

Tax Form Preparation

Posting Process Checks

Ledger Management

Data Entry & Reporting

Our Bookkeeping Assistants handle the day-to-day financial processes that keep your practice efficient and compliant. From invoicing and reconciliations to payroll and reporting, they ensure accuracy and reliability in every transaction. With the books under control, you can spend less time on admin and more time on your clients.

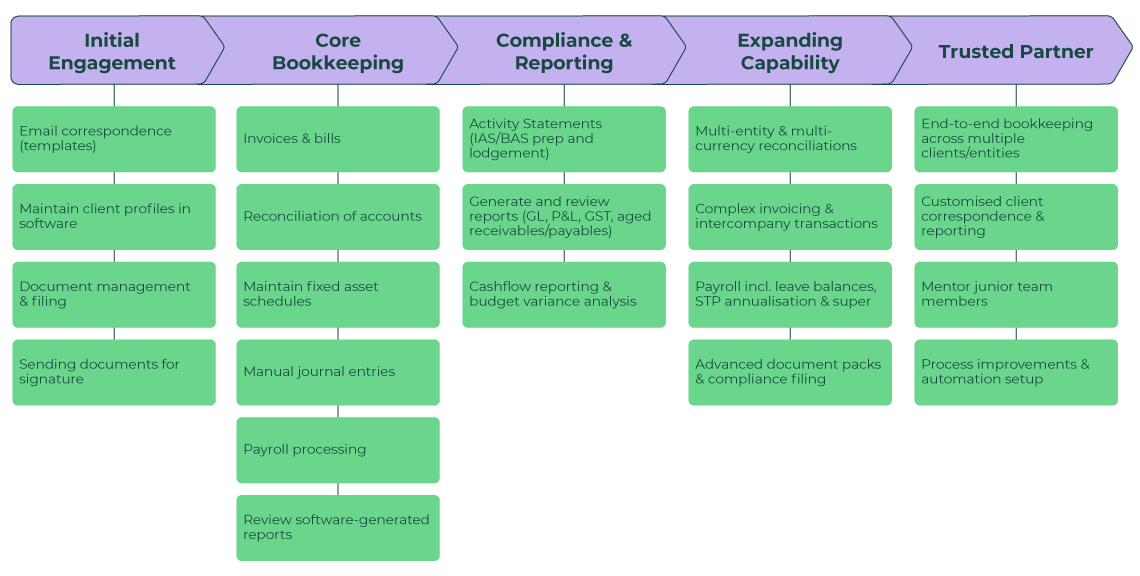

Team Capability

Client Testimonials

“What I love about working with VBP is the efficiency and support of someone who can be there. The team members from VBP are there when you need them, and I am there for them as well. They are part of the team and they made it a whole lot easier for us to do more. "

Nicholas Bregolin

Senior Financial Advisor

CBS Advisory

Why choose VBP?

Built for Financial Services

VBP specialises in supporting financial advisers, mortgage brokers, and accountants. Our team understands your industry’s compliance, confidentiality, and precision needs, so you get support that just gets it.

People-First, Performance-Driven

We invest in our people so they can invest in your business. With a strong focus on culture, development and wellbeing, our high-performing teams are more engaged, loyal and committed to your success.

Your Data Security Partner

VBP ensures the highest level of security and compliance to help protect your business while outsourcing.

Powered by Industry Business Leaders and Subject Matter Experts

Insights

Explore industry trends and strategies from our experts.

Offshoring, AI & the Future of Australian Accounting

How AI & RPA Digitally Transform Financial Planning

FAQs

A VBP Bookkeeping Assistant can assist with accounts payable and receivable, reconciliation, ledger maintenance, invoice and bill management, payroll processing, document prep and activity statements. They ensure your books are up-to-date and ready for reporting and compliance.

Bookkeeping Assistants handle day-to-day transaction processing, data entry and record-keeping, while accountants provide strategic financial advice, tax planning, compliance oversight and financial analysis. Our BKA role complements - rather than replaces - your local accountant.

No. Our Bookkeeping Assistants maintain accurate financial records but do not provide budgeting, forecasting, or financial planning. These are typically handled by senior accountants or business managers.

All Bookkeeping Assistants complete Xero Advisor and Payroll Certification as part of their onboarding. They also undergo in-house training in financial planning principles and bookkeeping fundamentals.

Bookkeeping Assistants complete a 3-week program that includes Xero system navigation, core bookkeeping tasks, privacy and information security training and practical case studies to prepare them for real-world advisory firm support.

We focus on high attention to detail, internal oversight and structured task workflows. Bookkeepers are trained to be proactive, responsive and collaborative, with a focus on getting it right the first time.

Yes. Our roadmap encourages starting with low-risk, template-based tasks before expanding to more complex or client-specific workloads over time. This ensures smoother onboarding and higher-quality outcomes.

Definitely. Our model is cost-effective and scalable ideal for small firms looking to reduce admin load, lower overheads and stay compliant without taking on full-time internal staff.

Yes. Our training program includes an overview of financial planning operations, client documentation and adviser workflows. This ensures your assistant understands the context they’re working in, not just the numbers.

Yes. They can support document prep, reconciliation, payroll finalisation and activity statements: ensuring clean, accurate records to streamline your year-end process or accountant handover.

VBP is ISO 27001 certified and compliant with Australian privacy laws. All work is conducted in secure systems with access controls, giving you full peace of mind around client data and financial records.

Start with the repetitive, process-driven work that takes time but doesn’t require client interaction: such as bank reconciliations, data entry, accounts payable/receivable or payroll support. Many firms then expand to include compliance and reporting (like BAS, GST, or management reports) once they see the quality and turnaround time from their offshore team.